The 2026 Housing Forecast: What It Means for Your Wallet in Chicago

If you’ve been following the national news, you’ve likely heard that the housing market is finally "thawing." After four years of volatility, from the pandemic boom to the frozen activity of 2023 and 2024, we are entering a new phase.

But here at the Alex Stoykov Group, we know that national headlines often fail to capture the reality of living in Chicago. While the rest of the country prepares for flat prices and surplus inventory, our local market is telling a different story. The "K-shaped" economy has created a split, and Chicago sits on a very specific side of that divide.

We’ve analyzed the data for 2026 to help you understand exactly what these trends mean for your buying or selling plans in the city this year.

The Chicago Exception: Outperforming the National Forecast

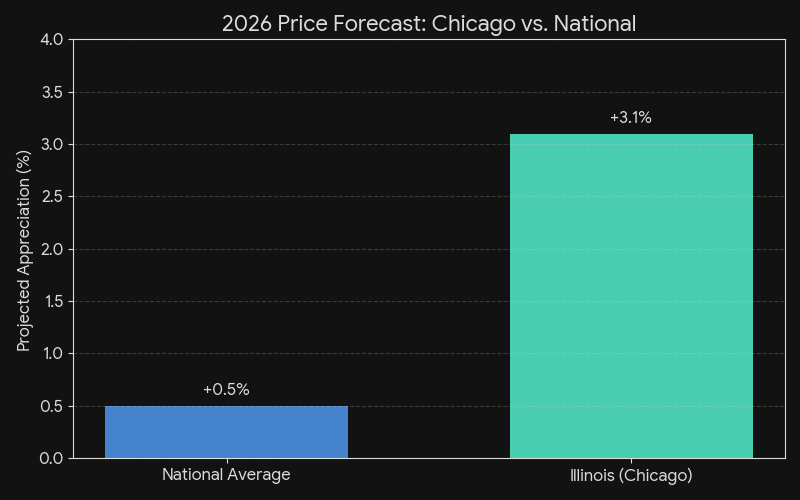

The national forecast for 2026 calls for home prices to remain essentially flat, with a projected increase of just 0.5%. However, real estate is hyper-local, and this is where Chicago diverges from the pack.

While Sun Belt markets like Austin and Tampa are seeing price corrections due to a surplus of homes, Chicago remains an inventory-constrained market. Because homeowners in northern cities have largely stayed put, our inventory is tighter than in the South.

What This Means for Your Wallet

For Sellers: Do not panic when you read about "stalling prices" in the national news. In supply-starved markets like ours (and places like Boston and New York), limited supply continues to support modest price gains. If you price your home correctly, you are still in a strong position.

For Buyers: The "bargains" appearing in Florida or Texas aren't happening here yet. However, affordability is improving in a different way: income growth. With average incomes rising at about 4% annually, your purchasing power is gradually catching up to prices.

Inventory: The "Lock-In" Effect is Finally Breaking

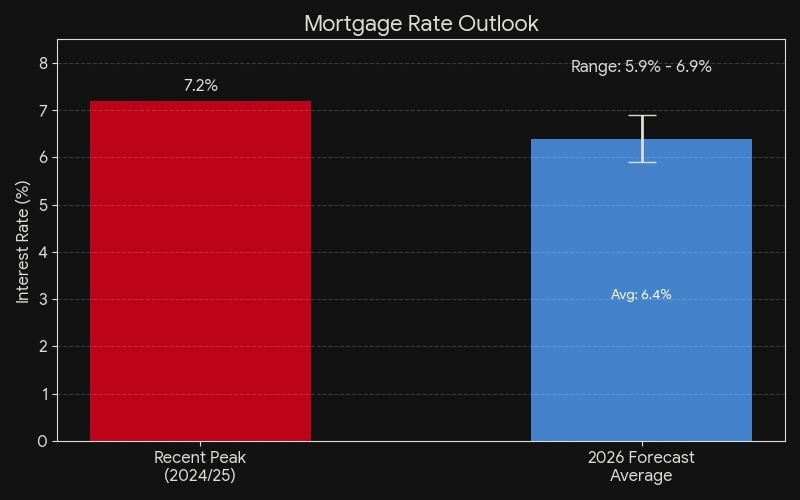

For the past few years, the Chicago market felt stuck. Many homeowners refused to sell because they didn't want to trade a 3% mortgage rate for a 7% one. This created a "Great Stay" that kept inventory artificially low.

That dynamic is finally shifting. By the end of 2025, nearly 20% of all outstanding mortgages nationally will carry rates above 6%.

What This Means for You

The "Shadow" Market: We are watching "shadow inventory," homes withdrawn by frustrated sellers in 2025, likely returning to the market this year.

More Options: We forecast national inventory to grow by roughly 10% in 2026. While Chicago won't see the massive surplus of the Sun Belt, we will see more homes hit the market than in 2024.

The Goldilocks Window: If mortgage rates settle into the high 5s or low 6s (our forecast average is 6.4% ), we expect a release of pent-up demand. This is your window to move before competition heats up further.

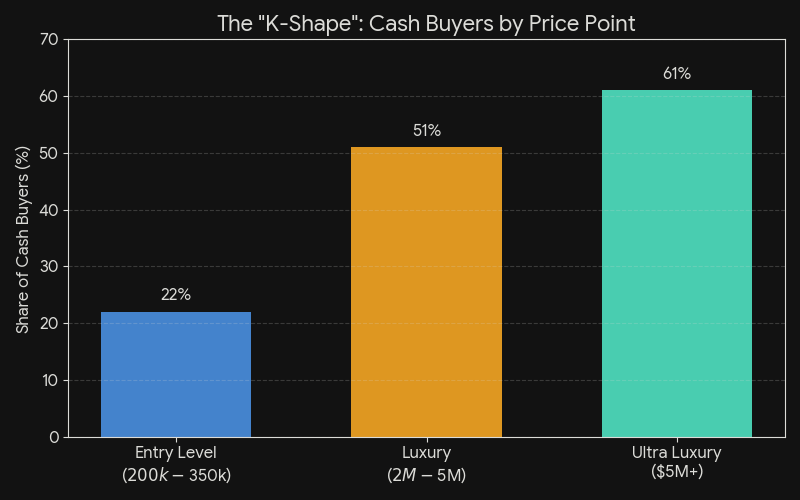

The "K-Shaped" Economy: Neighborhoods Matter More Than Ever

The economy is currently "K-shaped," meaning prosperity is divided. We see this clearly in Chicago: older, affluent households benefiting from stock market highs are driving the luxury market, while entry-level buyers feel the squeeze of inflation.

What This Means for You

Luxury Resilience: The luxury tier (homes priced in the top 25%) continues to outperform. Buyers here are often using cash or large down payments, making them less sensitive to daily rate changes.

Local Nuance: What is happening in Lincoln Park may be completely different from trends in the suburbs. While national averages mask these differences, local data reveals them.

The Bottom Line for 2026

The era of dramatic swings is ending. We are moving toward a more stable, predictable market.

If you are buying: You will likely have more choices this year than last, but don't expect prices in Chicago to drop like they might in the South.

If you are selling: The "lock-in" is fading, meaning you’ll face more competition from other sellers. Accurate pricing and local marketing are critical.

Real estate decisions shouldn't be based on national averages; they should be based on your neighborhood and your financial goals.

Curious how your specific home’s value fits into the 2026 Chicago forecast?

Contact the Alex Stoykov Group today!

Brokerage Disclosure & Market Disclaimer

All data and market insights referenced herein are derived from third-party sources and public reports believed to be reliable at the time of publication; however, accuracy and completeness cannot be guaranteed. Market data is time-bound and methodology-dependent and may vary by property type, price tier, neighborhood boundaries, and sample size. This content is provided for informational purposes only and does not constitute investment, tax, legal, or financial advice. Forecasts, projections, and forward-looking statements are estimates based on current market conditions and are subject to change without notice. Past performance is not indicative of future results. All real estate brokerage services are provided by Compass, Inc., a licensed real estate broker. The Alex Stoykov Group is a team of real estate licensees sponsored by Compass, Inc. All advertising is conducted under the direct supervision of the sponsoring broker. For any property listings owned solely by a licensee, advertisements will state “broker owned” or “agent owned” as required by applicable Illinois law.