The 2026 Real Estate Roadmap: Your 6-Month Plan for Success

If the last three years were defined by waiting and seeing, 2026 is the year of strategic action.

With the market stabilizing (prices flattening, inventory rising by roughly 10%, and mortgage rates settling into a predictable range), the panic of the pandemic years is gone. This means you no longer need to make split-second decisions. You have the luxury of time, but only if you use it wisely.

Whether you are looking to buy, sell, or invest in Chicago this year, readiness looks different in a stable market than it did in a chaotic one. Here is your educational guide to the ideal 6-month planning timeline.

For Buyers: The "Income-Over-Price" Advantage

While Goldman Sachs predicts home prices to rise 4.9%, other major analysts like Moody’s (+0.9%) and Zillow (+1.2%) expect them to remain essentially flat. Meanwhile, average wages are growing at roughly 4%. This "Affordability Convergence" means your purchasing power improves every month you wait—provided you are ready to strike when rates dip.

-

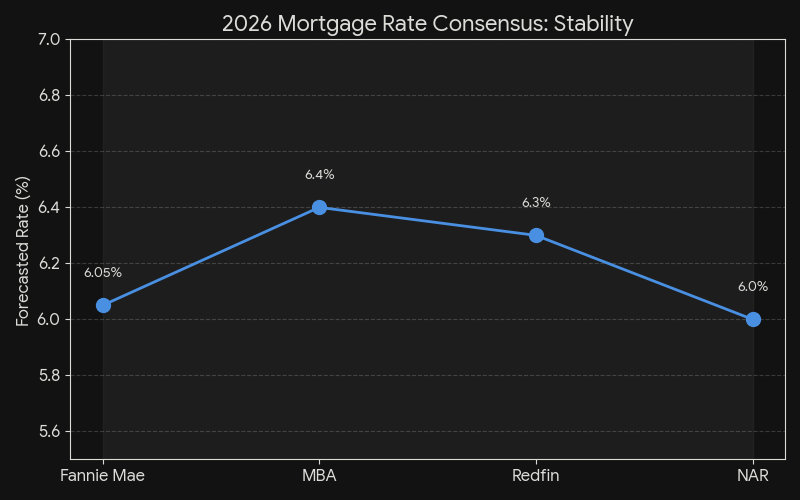

Leverage Your Credit Score: Mortgage spreads are narrowing. In a stable rate environment (forecasted average of 6.3 - 6.4%), your credit score is the biggest lever you control. A score of 740+ is your ticket to the "Goldilocks" rates in the high 5s.

Take Action: Audit your credit now. Paying down revolving debt today yields a higher return than saving for a slightly larger down payment.

-

Re-evaluate Inventory: Inventory is up 10%. This means you don't have to settle. Create a strict "Must Have" list. In past years, you bought what you could find; in 2026, you buy what you want.

Watch the "Shadow Demand": Be aware that many buyers are sitting on the sidelines waiting for rates to drop. When they move, they move fast.

-

Get Fully Underwritten: Don't just get pre-qualified. In a Chicago market that is still tighter than the national average, a full underwriting approval makes your offer look like cash.

Source: Compass 2026 Housing Market Outlook, Zillow, Fannie Mae

For Sellers: The "ROI" Reality Check

The "lock-in" effect is breaking, and more sellers are entering the market. You will face more competition this year than last. In a flat-price environment, you cannot rely on market momentum to sell your home; you have to sell it yourself.

-

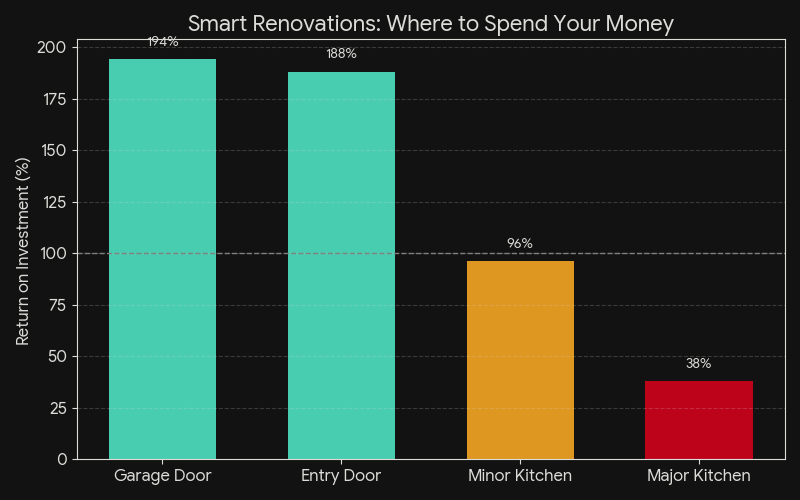

Renovate or Repair? With prices essentially flat, major renovations may not return 100% on investment. Focus on high-impact cosmetic fixes (paint, landscaping) rather than tearing down walls.

Check the "Shadow Inventory": Look at homes in your neighborhood that were withdrawn from the market last year. They are your future competition.

-

Stand Out: With inventory growing, buyers can be picky. Your home needs to look turnkey.

Pricing Strategy: This is crucial. Roughly 42% of listings took price cuts late last year. To avoid chasing the market down, we need to price accurately from Day 1.

-

Staging: Research shows that staged homes sell 73% faster than non-staged homes. In a market with 10% more inventory, you cannot afford to be the "tired" listing. Staging is no longer optional; it is your primary marketing tool.

Pre-Market Marketing: We start generating buzz before you hit the MLS. In a normalized market, days-on-market can creep up, so building early interest is key.

For Investors: The "K-Shape" Strategy

The economy is divided. High-income earners are thriving (driving luxury demand), while entry-level sectors are softer.

-

Unlike traditional buyers, your timeline is dictated by opportunity. Watch for "distressed" inventory, though broadly, distressed selling remains low.

-

Look for neighborhoods where mobility is just starting to unlock. These areas may see a sudden influx of inventory, creating negotiation opportunities for cash buyers.

The Bottom Line

2026 is a year for the prepared. The data shows a market that is forgiving to those who plan but punishing to those who gamble.

Buyers: Fix your credit to capture the low-end of the rate range.

Sellers: Focus on high-ROI cosmetic fixes, not gut renovations.

Investors: Pick your region wisely; the national average means nothing this year.

Need help building your personal 6-month plan?

Contact the Alex Stoykov Group today!

Brokerage Disclosure & Market Disclaimer

All data and market insights referenced herein are derived from third-party sources and public reports believed to be reliable at the time of publication; however, accuracy and completeness cannot be guaranteed. Market data is time-bound and methodology-dependent and may vary by property type, price tier, neighborhood boundaries, and sample size. This content is provided for informational purposes only and does not constitute investment, tax, legal, or financial advice. Forecasts, projections, and forward-looking statements are estimates based on current market conditions and are subject to change without notice. Past performance is not indicative of future results. All real estate brokerage services are provided by Compass, Inc., a licensed real estate broker. The Alex Stoykov Group is a team of real estate licensees sponsored by Compass, Inc. All advertising is conducted under the direct supervision of the sponsoring broker. For any property listings owned solely by a licensee, advertisements will state “broker owned” or “agent owned” as required by applicable Illinois law.