The Spring Market Has Already Sprung

If you were waiting for the groundhog to tell you when the real estate season starts, you’re already behind. While January's outlook was about a "thaw," February’s data confirms that the Chicago market hasn't just thawed…it’s heating up.

At the Alex Stoykov Group, we’re seeing an accelerated "spring market" that appears to have kicked off in mid-January, driven by a meaningful shift in mortgage rates and a surge in luxury activity.

Here is what the latest available data and forecasts reveal about the Chicago residential landscape as we move into 2026.

The 2026 Forecast: By the Numbers

Chicago’s residential market is entering the year in a strong position, based on current regional forecasts, particularly when compared to other major U.S. metros. While national headlines focus on volatility, our local indicators are showing signs of stabilizing into a steadier growth pattern.

Median Price Growth

The median home price in the Chicago metro area reached $369,051 through late 2025 (forecast baseline for the year ending Oct. 2025). Current forecasts project a ~4.9% increase to approximately $386,972* by October 2026.

*Actual outcomes will vary by neighborhood, property type, and price tier

Sales Momentum

Current forecasts project ~80,116 closed transactions through the year ending October 2026—about a 5.1% increase over the prior year.

Inventory Relief

Active listings dipped to 13,723 in December 2025, but the 2026 trajectory shows a projected ~9% year-over-year increase in inventory. This could offer buyers the first material relief in several years, depending on whether new listings outpace buyer demand in the spring and summer months.

Interest Rates: The "New Normal"

The psychological "lock-in" effect is finally breaking. As of mid-January 2026, the average 30-year fixed rate has settled around 6.1%*.

*Rates vary by borrower profile and lender

Expert Insight: Homeowners are increasingly moving past the “3% nostalgia.” We are seeing a growing acceptance of today’s rate environment, where some sellers prioritize lifestyle and quality of life over their previous mortgage terms.

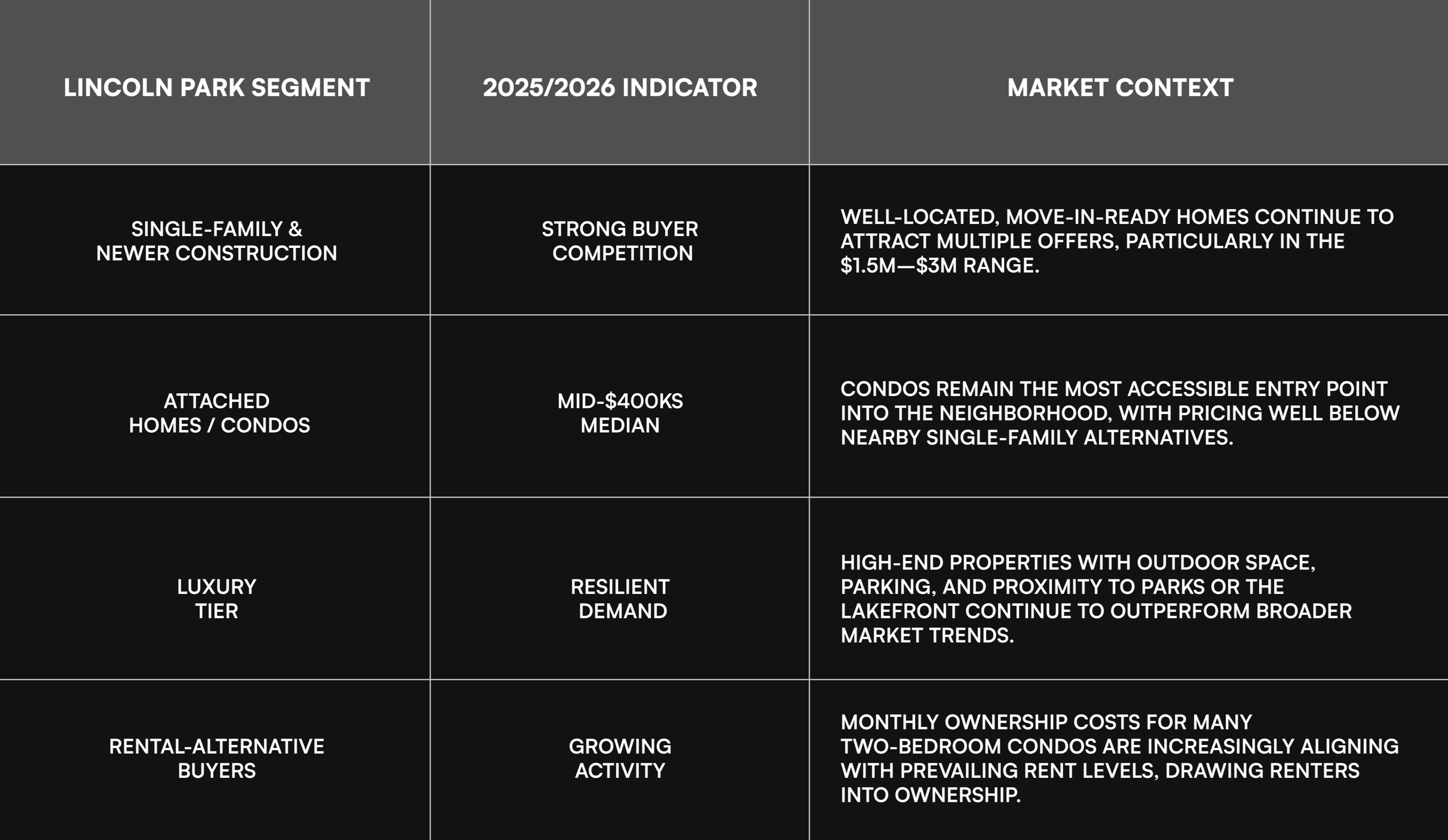

Lincoln Park Spotlight: A Micro-Market in Motion

Last month, we discussed the broader concept of a “K-shaped” economy. When you zoom in on Lincoln Park specifically, the data shows how that dynamic is playing out within a single, high-demand neighborhood—across price tiers and property types.

Note: These figures are high-level indicators based on recent transaction activity and market observations. Outcomes can vary depending on MLS boundary definitions, property condition, building amenities, and price-tier concentration.

The takeaway: In Lincoln Park, neighborhood reputation, walkability, and housing type matter as much as overall market conditions. Demand is not uniform—but well-positioned properties continue to command attention and pricing strength, even as buyers become more selective.

The Rent vs. Buy Reality

For those on the fence, the math is becoming more transparent. Chicago’s rental market continues to show strength, with rent growth ranking among the highest in the nation in recent reports. However, when you drill down into specific high-demand neighborhoods, the "cost of waiting" becomes even clearer.

The comparison below is illustrative and uses current market averages; actual costs vary by building, HOA structure, tax classification, and financing terms.

Average Rent (Lincoln Park 2-Bedroom): Current market data for a two-bedroom apartment in Lincoln Park shows average rents roughly in the mid-$3,000s, with some sources reporting ~$3,646 and others closer to ~$3,977.

Cost of Ownership ($400k 2-Bedroom): For a $400,000 condo with a 20% down payment and interest rates near ~6.1%, the estimated total monthly carrying cost—including principal, interest, taxes, insurance, and typical HOA fees—often falls between $3,000 and $3,400, depending on HOA structure, property taxes, and insurance.

In prime areas like Lincoln Park, the monthly cost of owning has actually begun to align with—or even undercut—average rents for comparable units. Because of this, many qualified buyers are entering the market now to position themselves for the potential ~5% home value appreciation currently forecasted for 2026, while locking in a fixed housing cost to avoid future rent increases.

What This Means for Your Property Goals

The market is no longer waiting for "the right time"—momentum is building now, and strategy matters more than ever. Whether you are looking to upgrade into a luxury lakefront property or navigate the competitive mid-market, having a data-driven strategy is your greatest asset.

If you are buying: You have more inventory to choose from than last year, but competition for move-in-ready homes can remain high (especially in sought-after neighborhoods).

If you are selling: Early-year momentum may be on your side, provided your home is positioned correctly for today's discerning buyers.

Real estate decisions shouldn't be based on national averages; they should be based on your neighborhood and your goals—in consultation with your real estate and financial advisors.

Ready to see how February’s market shift impacts your equity?

Contact the Alex Stoykov Group today!

Sources:

Chicago Agent Magazine - 2026 Outlook / DePaul Institute for Housing Studies Forecast Summary

FRED - Housing Inventory: Active Listings (Chicago CBSA)

Illinois REALTORS® 2026 Annual Forecast

Urban Institute - Chicago Zoning & Supply Research

Brokerage Disclosure & Market Disclaimer

All data and market insights referenced herein are derived from third-party sources and public reports believed to be reliable at the time of publication; however, accuracy and completeness cannot be guaranteed. Market data is time-bound and methodology-dependent and may vary by property type, price tier, neighborhood boundaries, and sample size. This content is provided for informational purposes only and does not constitute investment, tax, legal, or financial advice. Forecasts, projections, and forward-looking statements are estimates based on current market conditions and are subject to change without notice. Past performance is not indicative of future results. All real estate brokerage services are provided by Compass, Inc., a licensed real estate broker. The Alex Stoykov Group is a team of real estate licensees sponsored by Compass, Inc. All advertising is conducted under the direct supervision of the sponsoring broker. For any property listings owned solely by a licensee, advertisements will state “broker owned” or “agent owned” as required by applicable Illinois law.